Tools for Financial Caregivers of Older Adults

Financial caregiving is challenging, but luckily there is trusted help available. This webinar will help to acquaint you with the terminology and tools needed to manage someone else’s money in a responsible way.

Financial exploitations will be covered including COVID-19 healthcare scams. Please join us for this informative session on Friday, January 22 at 11 a.m. MST, 1 p.m. EST!

Click the names below to read about our upcoming speakers.

Lisa Schifferle

Lisa Weintraub Schifferle is a Senior Policy Analyst in the Consumer Financial Protection Bureau (CFPB)’s Office for Older Americans. She is the national lead of the Managing Someone Else’s Money program. She also supports the office’s work to combat elder financial exploitation.

Lisa Weintraub Schifferle is a Senior Policy Analyst in the Consumer Financial Protection Bureau (CFPB)’s Office for Older Americans. She is the national lead of the Managing Someone Else’s Money program. She also supports the office’s work to combat elder financial exploitation.

Ms. Schifferle’s career in consumer protection spans more than 20 years. Before coming to the CFPB, she spent 12 years at the Federal Trade Commission (FTC), where she trained consumers, businesses and advocates on scams, identity theft, and cybersecurity. She also served as the FTC’s Identity Theft Coordinator and litigated fraud and data security cases.

Ms. Schifferle spent eight years at the Maryland Legal Aid Bureau, as a staff attorney and supervising attorney. She represented low-income clients in consumer, bankruptcy, housing, public benefits and employment cases.

Ms. Schifferle received her B.A. summa cum laude from Yale College and her J.D. from the University of Virginia School of Law.

Desiree Lapahie

Desiree Lapahie is the data analyst for the National Indian Council on Aging (NICOA) and a member of the Navajo Nation. She is from Naschitti, New Mexico. She graduated with a Bachelor of Arts in economics from the University of New Mexico. She has experienced the struggles of being a caregiver while caring for her maternal grandmother.

Desiree Lapahie is the data analyst for the National Indian Council on Aging (NICOA) and a member of the Navajo Nation. She is from Naschitti, New Mexico. She graduated with a Bachelor of Arts in economics from the University of New Mexico. She has experienced the struggles of being a caregiver while caring for her maternal grandmother.

While working as a caregiver she realized the challenges the aging population faces. She started working as a public policy intern at the Alzheimer’s Association and advocated for policy changes that would benefit the aging population. She is honored to work with the amazing team at NICOA and help the American Indian and Alaska Native elders work towards a brighter future.

Managing Your Finances During a Pandemic

The COVID-19 pandemic has caused many of us to drastically alter our lives during the previous year. This new year provides a good opportunity to rethink our personal finances.

Start 2021 with a fresh approach to meeting your goals. Now is the perfect time to reset your cash flow, housing, retirement, and financial priorities. Join us for this informative discussion Wednesday, January 27 at 11 a.m. MST, 1 p.m. EST!

Click the names below to read about our upcoming speakers.

Martin Booker

Martin Booker is a Program Manager at AARP where he leads various financial education initiatives about investing, social security, and budgeting for the organizations’ 32 million membership-base.

Martin Booker is a Program Manager at AARP where he leads various financial education initiatives about investing, social security, and budgeting for the organizations’ 32 million membership-base.

After receiving a master’s degree in social work at the University of Connecticut, Martin worked in the nonprofit sector in Washington, D.C. and developed a passion for helping people improve their money habits.

During his time, he completed the Certified Financial Planner program at Georgetown University and learned how to teach others about money in a practical and actionable way. He has provided individual and group coaching services and classes, and leads workshops about credit, investing, retirement planning and other finance-related topics. Martin uses speaking opportunities to engage and educate people to better understand how to not only make but keep their money.

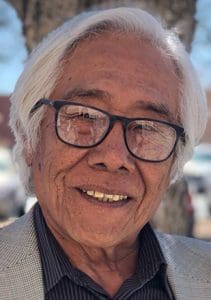

Larry Curley

Larry Curley is the executive director of the National Indian Council on Aging and a member of the Navajo Nation with over 40 years of experience working in the aging and healthcare fields. He has worked with Congress, other branches of the federal government, and national organizations on aging to develop support for programs affecting elder American Indians.

Larry Curley is the executive director of the National Indian Council on Aging and a member of the Navajo Nation with over 40 years of experience working in the aging and healthcare fields. He has worked with Congress, other branches of the federal government, and national organizations on aging to develop support for programs affecting elder American Indians.

After receiving his master’s degree in public administration at the University of Arizona, along with a certificate in gerontology, Larry worked as a gerontological planner at an Area Agency on Aging in Pima County, Arizona, where he was instrumental in establishing a county public fiduciary program. As a lobbyist in Washington, D.C., he successfully advocated for the passage of Title VI of the Older Americans Act, an amendment which he wrote.

He directed the Navajo Nation’s Head Start program, one of the five largest Head Start programs in the country. Larry has served as a nursing home administrator of a tribal, long-term care facility, as a hospital administrator in northern Nevada, and as a college instructor at the University of Nevada-Reno and Eastern Washington University.

He was named as the assistant dean of the Four Corners region for the Burrell College of Osteopathic Medicine. He’s also served as the public representative on the American College of Physicians Clinical Guidelines Committee, and as the director of program development for the Rehoboth McKinley Christian Health Care Services in northwest New Mexico.

Desiree Lapahie

Desiree Lapahie is the data analyst for the National Indian Council on Aging (NICOA) and a member of the Navajo Nation. She is from Naschitti, New Mexico. She graduated with a Bachelor of Arts in economics from the University of New Mexico. She has experienced the struggles of being a caregiver while caring for her maternal grandmother.

Desiree Lapahie is the data analyst for the National Indian Council on Aging (NICOA) and a member of the Navajo Nation. She is from Naschitti, New Mexico. She graduated with a Bachelor of Arts in economics from the University of New Mexico. She has experienced the struggles of being a caregiver while caring for her maternal grandmother.

While working as a caregiver she realized the challenges the aging population faces. She started working as a public policy intern at the Alzheimer’s Association and advocated for policy changes that would benefit the aging population. She is honored to work with the amazing team at NICOA and help the American Indian and Alaska Native elders work towards a brighter future.

Amazing tips! Its really helpful to the reader.